A Second Consecutive Pause In Interest Rates

Key points

- RBA keeps interest rates on hold

- Inflation has fallen to 6.0%

- Check your credit score to monitor your financial wellbeing

Interest rates remain steady

A second consecutive month without an interest rate hike is a relief for Australians.

A recent Roy Morgan study showed that between April and June, approximately 1.43 million mortgage holders (28.7%) were “at risk” of mortgage stress.^

The latest decision by the RBA gives some hope to struggling mortgage holders.

Are blue skies on the horizon?

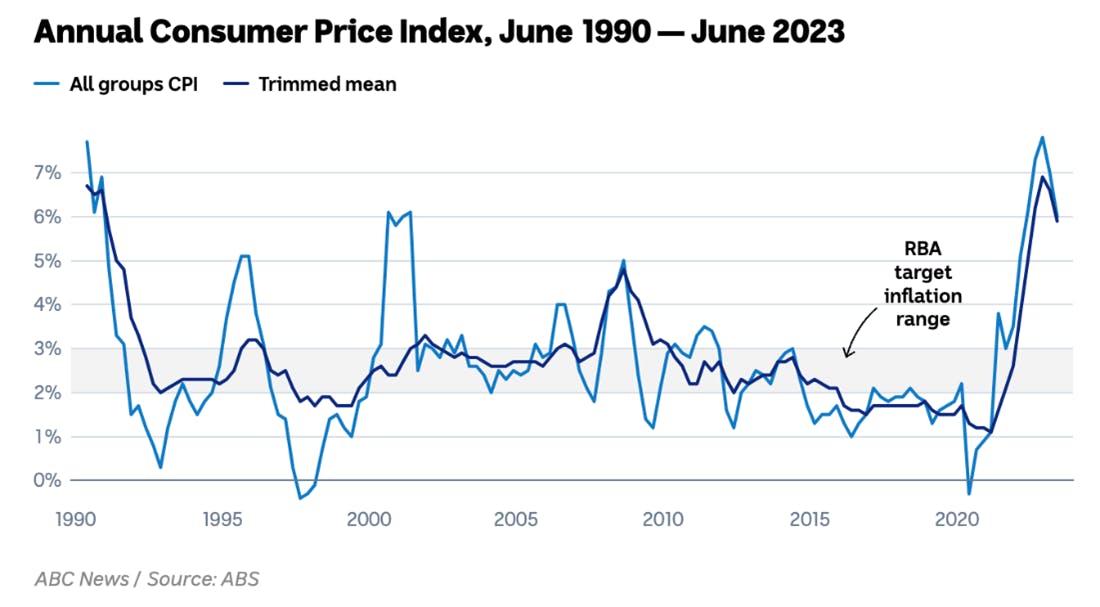

The annual inflation rate has fallen for the second consecutive quarter, coming in at 6.0%. There may be hope, but there is still a long way to reach the RBA’s target inflation rate of 2-3% which leaves the door open for future interest rate increases.

Some falling prices in the last quarterly inflation data have helped to lower inflation, including domestic travel and accommodation (-7.2%), electricity (-1.8%), clothing accessories (-2.2%) and fuel (-0.7%). At the same time, we can’t ignore rising rents (+2.5%), international holiday travel and accommodation (+6.2%), other financial services (+2.5%), new dwellings purchased by owner-occupiers (+1%) and food (+1.6%).

Another factor to take into account is the very low unemployment rate of 3.5%. The RBA previously stated that unemployment would need to be above 4% to bring inflation back down to 2-3%.

Considering all of this, economists are divided on when this rate rise cycle will end, how many more rate rises there need to be and whether rate cuts may be needed within several months.

The RBA stated that “some further tightening of monetary policy may be required to ensure that inflation returns to target in a reasonable timeframe, but that will depend upon the data and the evolving assessment of risks.”

How does this impact your credit score?

While blue skies may be near, the uncertainty on interest rates continues for now. It pays to be savvy about your finances. If you can’t meet rising repayments, it could impact your credit score. Our calculators and learning hub are here to support you.

^Roy Morgan 2023, https://www.roymorgan.com/findings/9289-mortgage-stress-risk-june-2023