PayID Scam Stories: Educate & Protect Yourself

“Selling a couch on Facebook. Got a message from someone who could pick up now or tomorrow and would PayID to secure it. When I said ‘cash only’ they responded they were out of town and their brother would be picking it up, it’s for him and he doesn’t have a bank account yet. I just stopped responding, too many red flags. But just curious, I thought PayID was supposed to be pretty fraud proof. Is that not the case?”

The above is a story posted on Reddit this year. Online trading sites like the Facebook Marketplace have become a common, convenient and quick option for many Australians. Unfortunately, the popularity of online marketplaces is growing in parallel to the reported scam activity. In 2022, more than $45 million was lost through fraudulent buying and selling schemes.*

We believe that education is a very important part of identity protection. Read on to better understand PayID scams and the red flags to watch out for so you don’t fall victim.

What is PayID?

PayID is a free payment method platform launched in February 2018, aiming to simplify the money transfer process by reducing the need to remember bank account details. It uses a person’s phone number, email address or ABN as a form of identification.

To make a payment, the person needs to type in one of those methods of identification and PayID will show the name of the intended recipient. If the details match, then the customer can authorise the payment to be made, or otherwise cancel the transaction.

How does a PayID scam work?

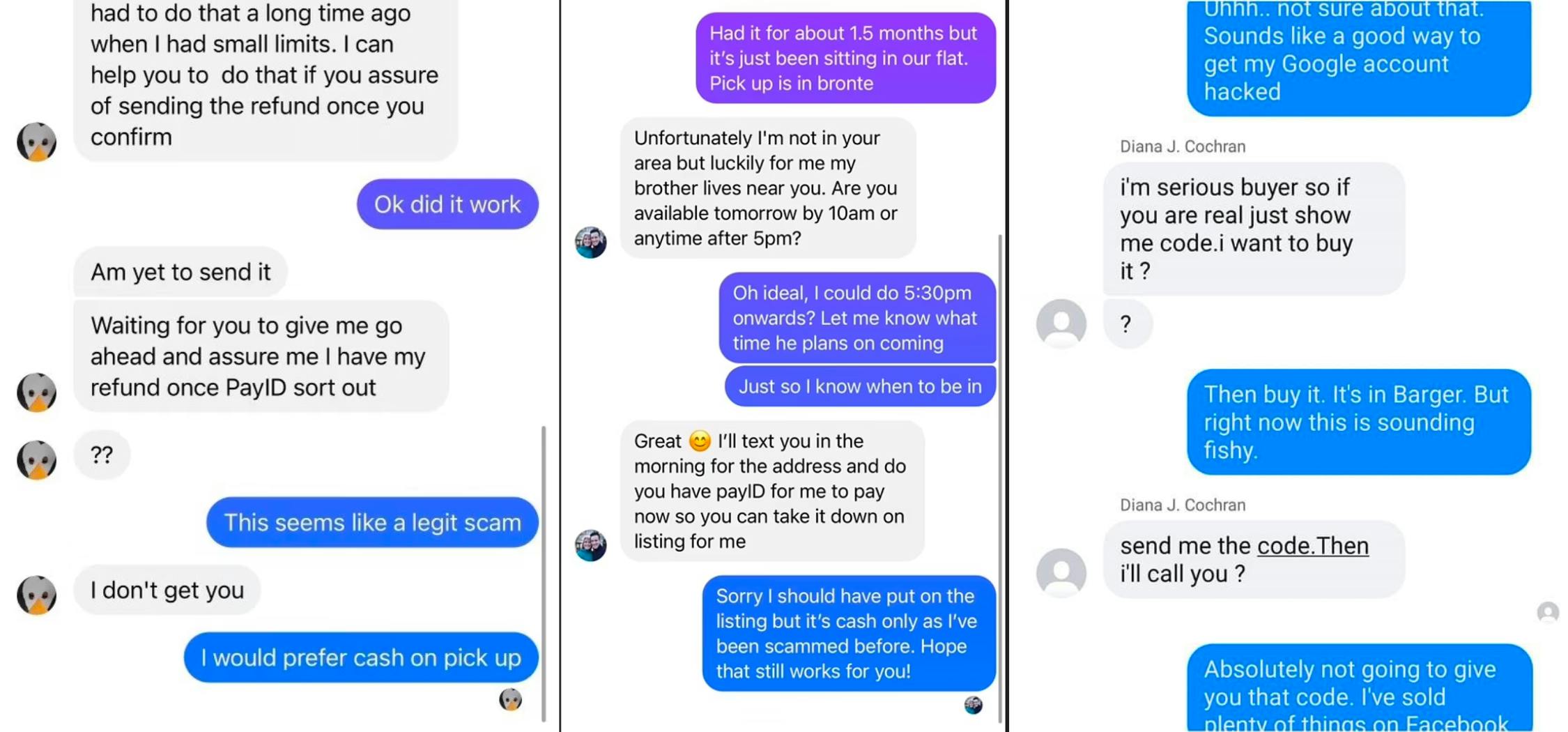

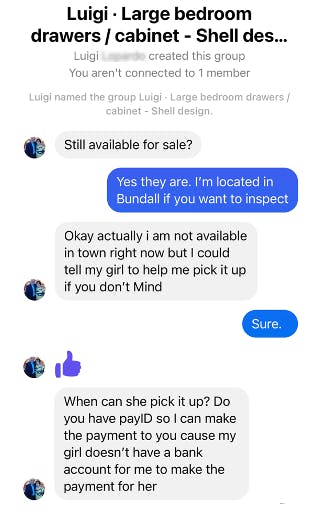

Let’s explore some other stories people have shared to educate their communities about the PayID scams. While reading these stories, keep the following in mind.

· PayID will never contact you directly, via email, text, or messenger.

· You will never need to send money first to receive a payment via PayID.

· You will never need to take any additional action, like upgrading your account or paying additional fees before money can be received or sent into your bank account.

“Happened to me too and it was hilarious, the scam is terrible.

Essentially they claim that their payment ($615 in my case) has been blocked by PayID because I need a business account, so the buyer needs to pay an additional $500 to secure a business account upgrade. They then ‘pay’ the additional $500 but request a refund so that PayID can release the “full” amount pending in your account ($1115 for me).

Essentially they’re trying to get you to transfer them $500.”

Can you spot the red flags in these examples? Remember to trust your instincts; if something sounds a bit off, don’t proceed with the transaction. Let’s take care of our community by informing our friends and family about the latest online scams. Stay safe.

*Source: 'What's your PayID?': How to avoid this scam when selling stuff online, SBS News